Yes, You Can Still Take Advantage of Cash for Clunkers …

But You Need to Know This First

by www.SixWise.com

The CAR Allowance Rebate System (CARS), formerly referred to as the Cash for Clunkers program, has been an incredible boon for Americans looking to save big money on a new car. The program is so popular that the first $1 billion in funding ran out in about one week.

|

You may be able to save thousands on the purchase or lease of a new car just by trading in your old clunker.

|

Earlier this month, the U.S. government approved another $2 billion to extend the program, which will run through November 1, 2009 or when the funds are exhausted, whichever comes first.

How Does Cash for Clunkers Work?

The program was put into place to help consumers buy or lease a new, more environmentally friendly vehicle in exchange for trading in their less fuel-efficient car or truck. Its primary goals include to:

If your vehicle qualifies for CARS, you will receive a credit of $3,500 or $4,500 to use toward the purchase or lease of a CARS-approved vehicle. You receive the credit from your car dealership at the time of purchase and any other vehicle incentives provided by the dealer are to be given in addition to the CARS credit. The dealer then submits a claim for reimbursement with the National Highway Transportation Safety Administration.

Further, because the program requires that your trade-in vehicle be scrapped, the dealer must give you an estimate of the scrap value, and that amount will also be applied to your purchase in addition to the rebate.

How do you know which credit you’ll qualify for?

The value of the credit depends upon the difference between the combined fuel economy of the vehicle that is traded in and that of the new vehicle that is purchased or leased. According to CARS.gov:

-

If the new vehicle has a combined fuel economy that is at least 4, but less than 10, miles per gallon higher than the traded-in vehicle, the credit is $3,500.

Do You Have to Pay Tax on the Rebate Amount?

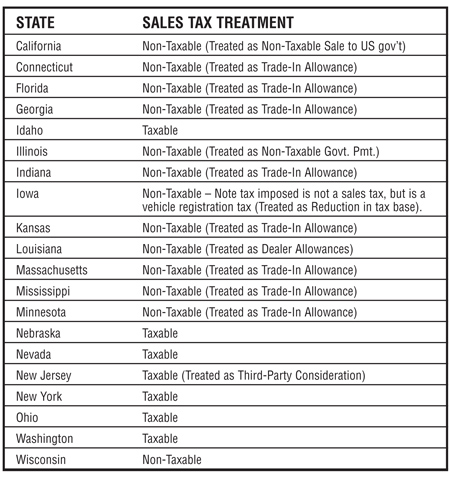

You will not owe income tax on the credit, as the CARS Act states the credit is not income for the consumer. However, whether you will owe sales tax on the amount depends on which state you live in. McDonald Hopkins, a multistate tax practice group, has compiled a summary chart detailing several states’ policies regarding the tax, as follows:

Source credit: McDonald Hopkins “Will You Owe Sales Tax On Your Clunker Rebate?”

If your state is not listed consult a tax advisor or review your state’s individual law.

|

Before you fall in love with a new car, check to make sure it (and your trade-in) qualifies for the rebate by using the CARS vehicle eligibility guide.

|

Which Vehicles are Eligible as Trade-Ins?

Your vehicle must be less than 25 years old on the trade-in date and, generally, trade-in vehicles must get 18 or less MPG (though some very large pick-up trucks and cargo vans have different requirements).

Further, your trade-in vehicle must be registered and insured continuously for the full year preceding the trade-in (New Hampshire and Wisconsin are exempt from this insurance requirement because they do not have an insurance requirement under state law).

To find out if your vehicle is eligible for trade-in and whether the new vehicle you plan to purchase qualifies for the rebate, please use the online CARS vehicle eligibility guide.

What Should You Bring to the Dealership?

First, make sure your dealer is a participating dealer by reviewing this CARS Dealer Locator.

You don’t need a voucher or any enrollment information to have the credit applied to your purchase, however the dealer will need to see:

-

One-year proof of insurance (contact your insurance company to get this)

-

Proof of registration that dates back at least one year

-

A “clear” title (the title must be free of any liens or other encumbrances)

-

The vehicle manufacturer date (typically located on the driver’s door or door jamb) must be less than 25 years old when you trade it in

Finally, the dealer will also ask you to certify to the following under penalty of law:

-

The trade-in is in drivable condition.

-

You are the registered owner, and have been for at least the last year.

-

The trade-in has been continuously insured for the last year.

-

The trade-in is titled in your name and has been for the last year.

-

You have not previously participated in the CARS program.

If you are in the market for a new fuel-efficient vehicle, and have an eligible trade-in, taking advantage of the CARS program is an easy way to save $3,500-$4,500 on your purchase or lease. For even more money-saving auto shopping tips, be sure to read through the Recommended Reading articles below.

Recommended Reading

The 15 Most Overpriced Cars … and The 20 Best Auto Bargains (Plus, Why to Act Now if You’re in the Market for a New Car)

The Top 23 Gas-Saving Cars

Sources

CARS.gov Car Allowance Rebate System

McDonald Hopkins Multistate Tax Practice “Will You Owe Sales Tax On Your Clunker Rebate?” June 24, 2009